Trade Finance

Flexible lending solution: Ebury Trade Finance. Our lending solution provides you with credit to help finance your international imports

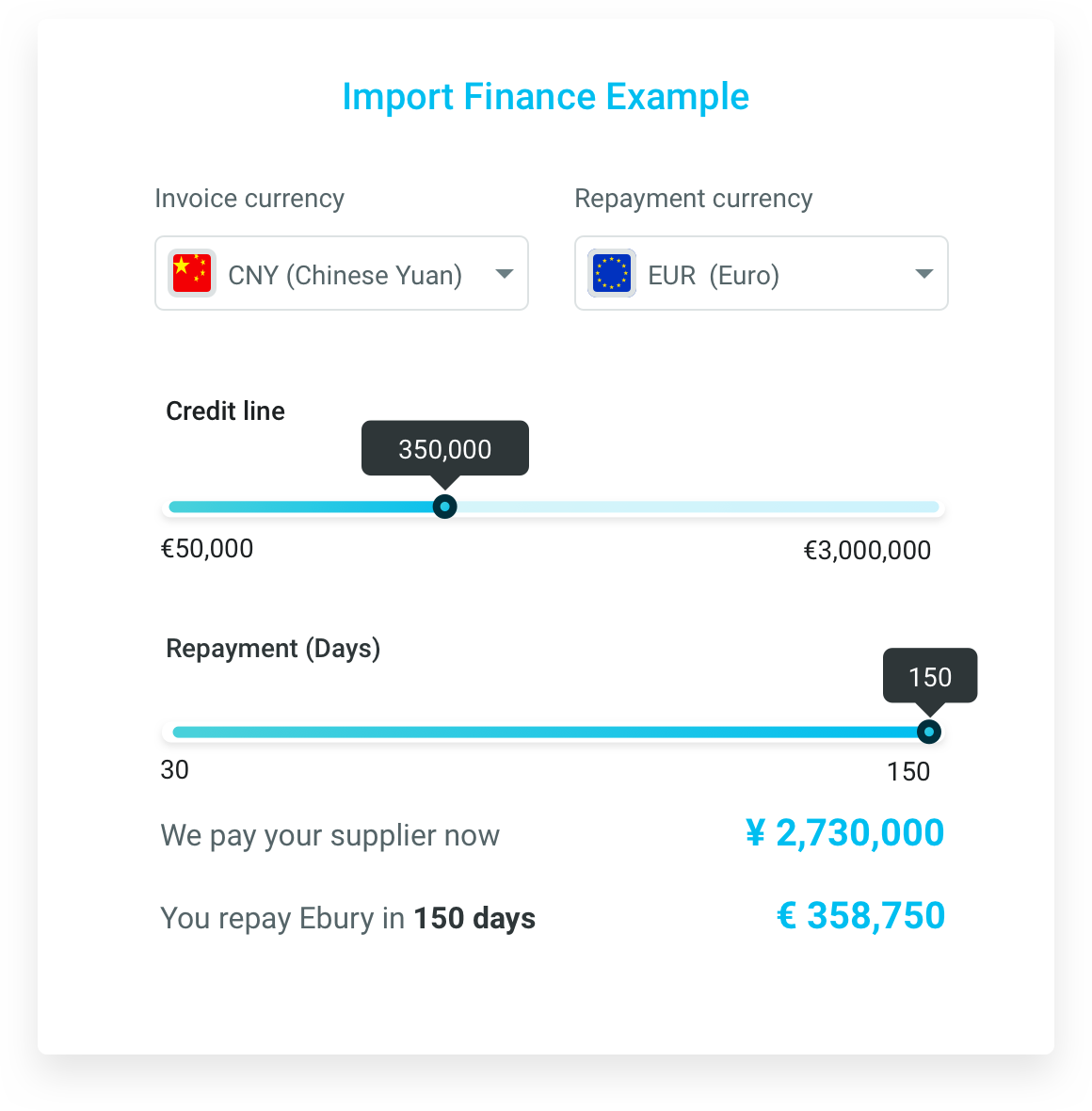

*Representative example of 0.5% per month funding cost and EUR/CNY=7.80

Reduce your cash-flow gap

Get credit to help finance your international imports

- Pay as you go: There are no up front or hidden fees, meaning you can use the facility whenever you like without incurring unnecessary costs

- Pay us back 150 days later: Reduce your liquidity needs with our longer payment terms

- Your goods are yours: We take no collateral, which means there’s no impact on any existing credit lines you have

WHY CHOOSE EBURY’S TRADE FINANCE?

How does trade finance work?

1

Your supplier sends you an invoice

2

You forward the invoice to Ebury and Ebury pays your supplier in any currency

3

You sell your goods or services

4

You repay Ebury up to 150 days later in your domestic currency

exporter

Provide your buyers credit to finance your international or domestic trades

- Pay as you go: there are no up front or hidden fees, meaning you can use the facility whenever you like without incurring unnecessary costs

- Receive payment straight away: with your buyers repaying when the invoice is due (up to 120 days later)

- Your goods are yours: we take no collateral, which means there’s no impact on any existing credit lines you have

WHY CHOOSE EBURY’S TRADE FINANCE?

As an exporter, how does trade finance work?

1

You sell your goods or services and invoice your client

2

You upload the invoice to Ebury's platform and Ebury pays you 90% of the invoice up front

3

Your client repays up to 120 days later

4

Ebury pays you the remaining 10% minus any interest